Silver Elephant‘s Sunawayo Returns Assays up to 477g/t Silver and 20% Lead; All 48 Collected Samples from 4 Areas Return Anomalous Assayed Grades

Vancouver, British Columbia, September 28, 2020 – Silver Elephant Mining Corp. (“Silver Elephant” or “the Company”) (TSX: ELEF, OTCQX:SILEF, Frankfurt:1P2N) announces that all of the initial forty-eight chip and grab samples collected from surface outcrops and adits at its Sunawayo silver project (“Sunawayo”) returned anomalous Ag-Pb assayed values. Ten of the assayed samples contain either over 100g/t silver or 10% lead or both. The results vastly exceeded the Company’s expectations and are an early indication of the potential for multiple mineral discoveries at Sunawayo.

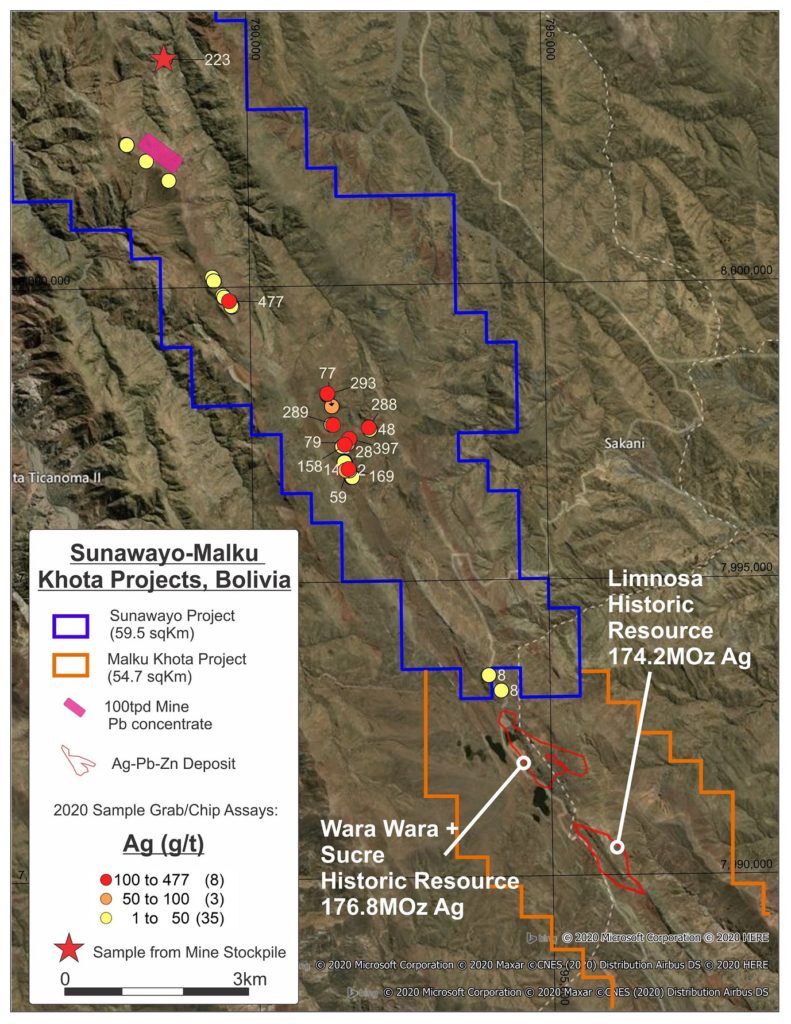

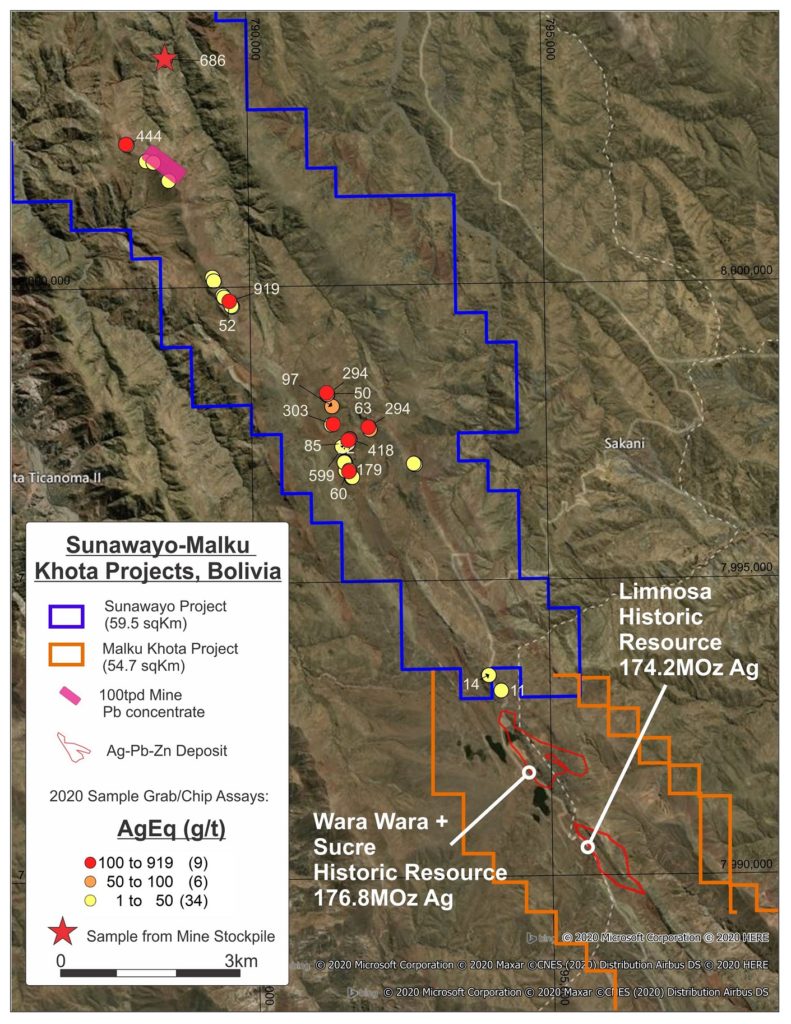

Located in central Bolivia, the Company’s Sunawayo project is contiguous with the Malku Khota project (“MK”). The Malku Khota deposit with a 350million-oz historic silver resource sits 200 meters south of the SunawayoMK border (“MK Border”). Sunawayo features a 17km property extent which covers 59.5 square km of prospective area and includes an active 100 ton-per-day open-pit mining operation located 10km north of the MK Border

In the Company’s first-pass reconnaissance, undertaken while possessing only limited site data, Silver Elephant geologists identified at least four high priority areas along the 11km lithological trend that hosts the Malku Khota deposit. These areas are called Caballo Uma, Pujiuni, Mine Area and MK Border.

Sunawayo photos, and maps of the sample locations are posted at http://www.silverelef.com.

Subscribe to receive Elephant news the moment it’s out by email for free

Caballo Uma (28 samples; 1.6km by 1.0 km)

Caballo Uma is located approximately 7km south of Mine Area and 5 km northwest of MK Border. There are numerous adits at Caballo Uma, with samples returning high grade silver values over a span of 1.6 km in a southeast-northwest trend. Company geologists observed mineralization associated with extensive, multiple east-west trending vein systems, stockworks, and hydrothermal breccias. Results from Caballo Uma are tabulated below:

| Sample ID | Area | Type | Ag (g/t) | Pb % | Zn % | AgEq (g/t) |

| 93323 | Caballo Uma | CHIP | 397 | 2.63 | 0.67 | 475 |

| 93329 | Caballo Uma | CHIP | 293 | 4.26 | 2.04 | 448 |

| 93327 | Caballo Uma | GRAB | 289 | 1.92 | 0.44 | 344 |

| 93324 | Caballo Uma | GRAB | 288 | 0.27 | 0.01 | 294 |

| 93303 | Caballo Uma | CHIP | 169 | 12.55 | 0.26 | 452 |

| 93321 | Caballo Uma | GRAB | 158 | 20.00 | 0.01 | 597 |

| 93322 | Caballo Uma | GRAB | 79 | 1.14 | 0.18 | 110 |

| 93328 | Caballo Uma | GRAB | 77 | 0.61 | 0.24 | 97 |

| 93302 | Caballo Uma | CHIP | 59 | 3.02 | 0.03 | 126 |

| 93325 | Caballo Uma | GRAB | 48 | 0.07 | 0.44 | 63 |

| 93330 | Caballo Uma | GRAB | 48 | 10.05 | 2.35 | 339 |

| 93305 | Caballo Uma | CHIP | 28 | 4.08 | 0.02 | 118 |

| 93319 | Caballo Uma | CHIP | 23 | 1.73 | 0.03 | 62 |

| 93320 | Caballo Uma | GRAB | 22 | 1.40 | 0.02 | 53 |

| 93301 | Caballo Uma | CHIP | 14 | 3.94 | 0.01 | 101 |

| 93306 | Caballo Uma | CHIP | 12 | 1.43 | 0.01 | 44 |

| 93316 | Caballo Uma | GRAB | 9 | 2.81 | 0.61 | 89 |

| 93326 | Caballo Uma | CHIP | 9 | 0.02 | 0.03 | 10 |

| 93314 | Caballo Uma | CHIP | 8 | 2.79 | 0.45 | 83 |

| 93317 | Caballo Uma | CHIP | 7 | 0.59 | 0.01 | 20 |

| 93313 | Caballo Uma | CHIP | 6 | 1.62 | 0.41 | 54 |

| 93307 | Caballo Uma | GRAB | 5 | 3.43 | 0.01 | 81 |

| 93304 | Caballo Uma | GRAB | 5 | 0.33 | 0.00 | 12 |

| 93315 | Caballo Uma | CHIP | 3 | 0.50 | 0.03 | 15 |

| 93318 | Caballo Uma | CHIP | 3 | 0.36 | 0.10 | 14 |

| 93308 | Caballo Uma | GRAB | 2 | 0.87 | 0.08 | 23 |

| 93311 | Caballo Uma | GRAB | 0 | 5.36 | 2.70 | 199 |

| 93312 | Caballo Uma | GRAB | 0 | 0.20 | 2.24 | 72 |

Pujiuni (11 samples; 1.0 km by 0.5 km)

Pujiuni is 3.5 km south of Mine Area and 8.5km northwest of MK Border. It has several artisanal workings; some possibly dating back to Spanish-era 1800’s. The Pujiuni area is known locally to carry high grade silver minerals. One hydrothermal breccia returned the highest silver assay at 477 g/t silver, and over 20% lead. Mineralization is disseminated in sandstones or as stockwork veins in hydrothermal breccias. These features have also been observed in the Malku Khota deposit. Pujiuni results are tabulated below:

| Sample ID | Area | Type | Ag (g/t) | Pb % | Zn % | AgEq (g/t) |

| 93337 | Pijiuni | CHIP | 477 | >20 | 0.02 | 916 |

| 93334 | Pijiuni | CHIP | 37 | 4.28 | 0.03 | 132 |

| 93336 | Pijiuni | CHIP | 35 | 0.59 | 0.13 | 52 |

| 93338 | Pijiuni | CHIP | 22 | 0.63 | 0.16 | 41 |

| 93335 | Pijiuni | GRAB | 20 | 0.37 | 0.01 | 28 |

| 93339 | Pijiuni | GRAB | 15 | 0.32 | 0.25 | 29 |

| 93332 | Pijiuni | CHIP | 13 | 1.88 | 0.07 | 56 |

| 93342 | Pijiuni | CHIP | 12 | 0.96 | 0.02 | 34 |

| 93341 | Pijiuni | CHIP | 11 | 0.40 | 0.02 | 20 |

| 93331 | Pijiuni | CHIP | 9 | 1.11 | 0.11 | 37 |

| 93333 | Pijiuni | CHIP | 8 | 0.26 | 0.04 | 15 |

Mine Area (7 samples; 2.0km by 0.5km)

The current 100 tonne-per-day mining operation (“Mine Area”) is located 10km from MK border. The area features a 180m by 70m small pit at 30 meters depth, and several surrounding quarries. The mined materials are fed first to a crusher, and then to a gravimetric concentrator. The lead concentrate is produced and exported. A single mine-feed sample taken from the crusher assayed 223 g/t silver and over 20% lead. Below the pit there are underground workings for silver mineral extraction. The Company plans to maintain the status quo for the mining operation but possibly expand it in latter part of 2021 after evaluation. The priority for the Company is to explore the property-wide mineral potential of Sunawayo. Samples from Mine Area are shown below:

| Sample ID | Area | Type | Ag (g/t) | Pb % | Zn % | AgEq (g/t) |

| 93344 | Mine Area | GRAB | 6 | 1.56 | 0.61 | 58 |

| 93343 | Mine Area | GRAB | 4 | 0.24 | 0.02 | 10 |

| 93347 | Mine Area | GRAB | 3 | >20 | 0.01 | 442 |

| 93345 | Mine Area | GRAB | 2 | 1.84 | 0.03 | 43 |

| 93346 | Mine Area | GRAB | 1 | 14.20 | 0.25 | 320 |

| 93349 | Mine Area | CHIP | 1 | 2.85 | 0.01 | 64 |

| 93348 | Mine Area | GRAB | 0 | 1.83 | 0.66 | 60 |

MK Border (2 samples, border length 3km)

Just two samples were taken from sandstones at road cuts at the 3km-long the Sunawayo-Malku Khota border (“MK Border”). Both samples showed the presence of silver as shown below:

| Sample ID | Area | Type | Ag (g/t) | Pb % | Zn % | AgEq (g/t) |

| 93310 | MK Border | GRAB | 8 | 0.05 | 0.17 | 14 |

| 93309 | MK Border | GRAB | 8 | 0.01 | 0.10 | 11 |

48 chip and grab samples, range in length from 1 to 4 meters (2.4-meter average).

Silver equivalent calculation uses a silver price of $25.00/oz, a zinc price of $1.10/lb., a lead price of $0.80/lb. (all USD), and assumes a 100% metallurgical recovery. Silver equivalent values can be calculated using the following formula: AgEq = Ag g/t + (Zn % x 30.1644 ) + (Pb % x 21.9377). Samples indicating >20% Pb are calculated using 20% Pb.

Joaquin Merino, VP for South America Operations, commented: “We are impressed by the size of Sunawayo and by what we saw in the geology: intense alternation near the surface, coinciding with numerous tunnels and artisanal workings in various parts of the project. These confirmation assay results give us the first tell-tale signs that there may be a cluster of deposits in this 110 km2 Sedex system.”

With a daily COVID infection count of below 500 in Bolivia, the Company is mobilizing to start geological and structural mapping to ascertain the primary controls and trends for mineralization at Sunawayo. This work will lay the foundation for defining drill targets by year’s end.

About Sunawayo, Malku Khota, and Sedex deposits

Sunawayo is patented land which Silver Elephant has acquired from a private party (refer to the new release dated September 8th, 2020), while Malku Khota (containing a historic resource of 350-million-oz silver based on 42,704 meters of drilling between 2007 and 2010) is unpatented land administered by the Bolivian government. In January 2020, Silver Elephant applied for a mining production contract with the Bolivian government that would give it the rights to mine and explore Malku Khota. The application is under review.

A combined Sunawayo-Malku Khota district would feature a 34 km property extent encompassing an area of over 110 square kilometers. The district is situated within one very large hydrothermal system and is remarkably under-explored. Roughly 3.5 km of the strike from MK border into Malku Khota project, has been drilled. Yet the Malku Khota lithological trend and host-sandstone units extend for another 8 km northwest into Sunawayo without having received a single exploration drill hole.

Sedex-style silver-lead-zinc deposits account for 50% of the world’s lead and zinc reserves and 30% of the world’s silver resources (2019 USGS Data). Large, regional scale Sedex systems can span hundreds of kilometers, forming large tonnage deposits. Examples are Glencore’s Mount Isa mine and Teck’s Red Dog mine.

Qualified Person

The technical contents of this news release have been prepared under the supervision of Danniel Oosterman, VP Exploration. Mr. Oosterman is not independent of the Company in that he is employed by it. Mr. Oosterman is a qualified person (“QP”) as defined by the guidelines in NI 43-101. Historic resource numbers for the Malku Khota project cited in this release are taken from the May 10, 2011 Technical Report completed by Geovector Management Inc., AGP Mining Consultants, and Pennstrom Consulting. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserve, and the Company is not treating the historical estimate as current mineral resources or mineral reserves.

Quality Assurance and Quality Control

Silver Elephant adopts industry-recognized best practices in its implementation of QA/QC methods. Rock chip samples average between 4 and 6 kg. Samples are shipped to ALS Global Laboratories in Ururo, Bolivia for preparation and then shipped to ALS Global laboratories in Lima, Peru for analysis. Samples are analyzed using Intermediate Level Four Acid Digestion. Silver overlimits (“ore grade”) are analyzed using fire assay with a gravimetric finish. The ALS Laboratories sample management system meets all the requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. All ALS geochemical hub laboratories are accredited to ISO/IEC 17025:2017 for specific analytical procedures. A geochemical standard control samples are inserted into the sample stream. The laboratory also includes duplicates of samples, standards and blanks for additional QA/QC. Check assays are reviewed prior to the release of data. Assays are also reviewed for their geological context and checked against field descriptions.

Subscribe to receive Elephant news the moment it’s out by email for free

About Silver Elephant

Silver Elephant is a premier silver mining company. The Company’s goal is to enable shareholders to own as much silver in the ground as possible.

SILVER ELEPHANT MINING CORP.

ON BEHALF OF THE BOARD

“Joaquin Merino”

VP For South America Operation

For more information about Silver Elephant, please contact Investor Relations:

+1.604.569.3661 ext. 101

ir@silverelef.com www.silverelef.com

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts are forward-looking information within the meaning of applicable securities laws. Such forwardlooking statements, which reflect management’s expectations regarding Company’s future growth, results of operations, performance, and business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

These factors should be considered carefully, and readers should not place undue reliance on the Company’s forwardlooking statements. The Company believes that the expectations reflected in the forward-looking statements contained in this news release and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events, or results not to be as anticipated, estimated, or intended. The Company undertakes no obligation to publicly release any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.